We are digital pioneers

We have been developing technology serving organisations and people since 1998.

Accredited competence

We work in accordance with the requirements of ISO 9001 (Quality management), ISO 20000 (IT services management), ISO 27000 (Information security) and ISO 14001 (Environmental) standards, therefore we guarantee the highest quality of services from customer needs analysis and solution design to product development, further maintenance and development.

IS architect (analyst)

We are a small but strong team consisting of experienced business analysts, system engineers, user interface designers, programmers, user-friendliness analysts and consultants in various fields.

Usability

In order to create a people-oriented system, it is necessary to evaluate the product being developed from a user perspective. Evaluation in the early stages of project implementation allows the identification of additional user needs, learning about the advantages and disadvantages of the developed product, assessing whether user expectations are met, comparing alternative navigation, design and functional solutions, and selecting the most appropriate ones.

Recent projects

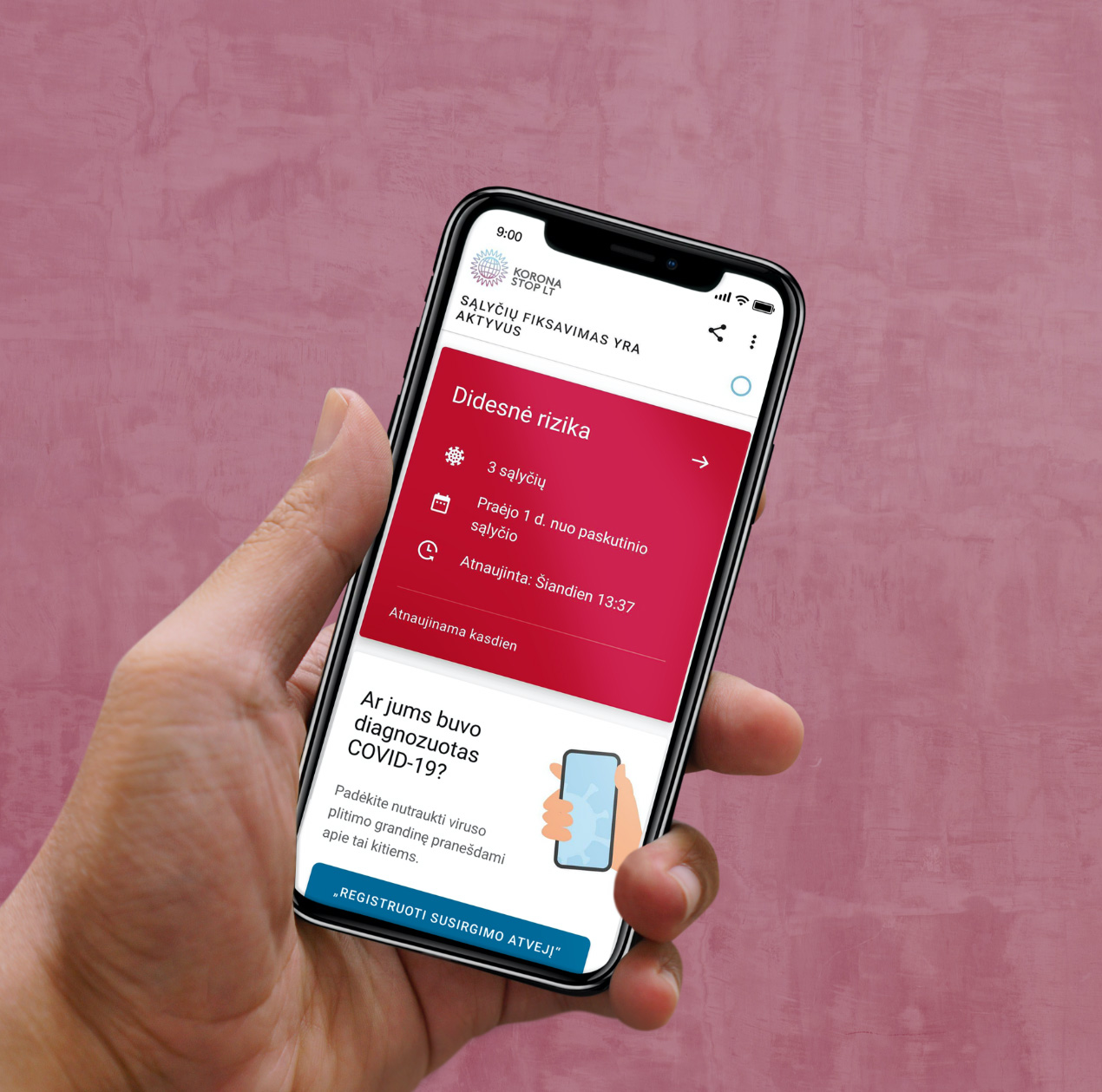

KORONA STOP LT mobile app

The official Lithuanian app is designed to warn users about the presence of people who have reported COVID-19, and to assist in the epidemiological surveillance and monitoring of patients.

The app captures the proximity of its users based on the strength of the Bluetooth signal and determines the risk of infection by analyzing such data, the duration of proximity, the risk of transmission of COVID-19 to a person and the time elapsed since the contact occurred. The app is integrated with the European Union alert system and ensures the exchange of data between different users of the app in EU countries.